CHANGING PLACES: Keith Weed, Ewen Sturgeon, Mark D’Arcy…

People change positions, get promoted or move to other companies. Portada is here to tell you about it.

People change positions, get promoted or move to other companies. Portada is here to tell you about it.

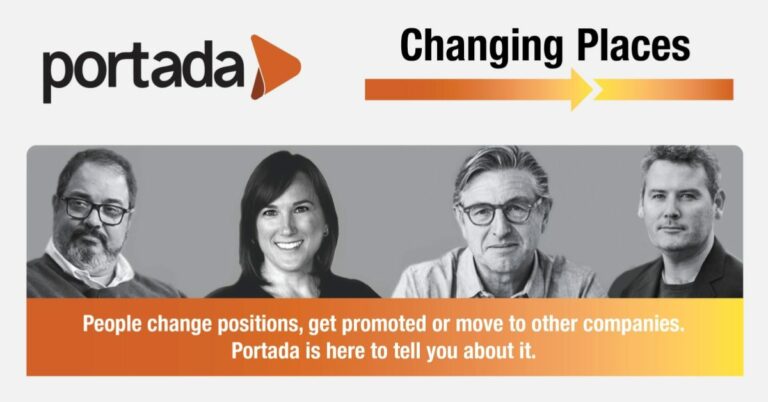

Mitú has carved out a niche in the social space, helping brands leverage the World Cup to engage millennial Latinos. The example set by Mitú at World Cup can serve as a template or at least a starting point for brands to connect with Hispanics through grand-scale sporting events.

The PGA Tour is continuing its partnership with social media network mitú, which reaches a massive, cross-cultural audience. Hispanics aren’t traditionally huge golf consumers, but some specific strategies by the PGA Tour can help it market its Latino stars and build that fan base.

People change positions, get promoted or move to other companies. Portada is here to tell you about it.

People change positions, get promoted or move to other companies. Portada is here to tell you about it.

Former President of Nickelodeon and President of BBC Worldwide North America Herb Scannell has been named CEO of mitú, the leading digital media brand for Latino millennials.Scannell will assume his position immediately, and will be based at mitu’s headquarters in downtown Los Angeles.

WPP has made an startegic investment in 88rising, Inc. (“88rising”), a US-based producer of digital content catering to the Asian millennial market.The investment completes WPP’s other multicultural investment in companies such as Woven Digital, which creates content for the millennial male market in the US, and Mitú, the digital media company focused on developing content for Latino youth in the US and worldwide.

A summary of the most exciting recent news in online video and ad-tech in the US, US-Hispanic and Latin American markets. If you’re trying to keep up, consider this

Major Multi Channel Networks (MCN’s), or Multiplatform Networks (MPN’s) like some want to be called, are expanding into Latin America. Latin America is a region which is almost a natural extension for those who are already present in the U.S. Hispanic market. MiTú Network is one of the main platforms entering the Latin American market. Portada talked to Adeline Cassin, Head of International Revenue at MiTú Network, about the platform’s expansion into Latin America.

Last week our Digital Media Correspondent Susan Kuchinskas reported about the maturing Newfronts Marketplace, the digital upfronts that are finishing today in New York City after two very hectic weeks. Now let’s look at the most important Multicultural related news that came out of the 2015 NewFronts.

Through Youtube’s Partner Program, users that generate and upload original content can earn revenue from the ads that appear on their own channel. While this has happened for years already in the U.S., it is a relative novelty in the U.S. Hispanic market and Latin America…and not least in Spain, where Madrid headquartered MCN 2Btube has Pan-Latin ambitions.

Through Youtube’s Partner Program, users that generate and upload original content can earn revenue from the ads that appear on their own channel. While this has happened for years already in the U.S., it is a relative novelty in the U.S. Hispanic market and Latin America…and not least in Spain, where Madrid headquartered MCN 2Btube has Pan-Latin ambitions.

Hispanic YouTube stars come out of nowhere … Una chica makes some videos in her bedroom. Two years later, maybe she’s talking to 15 other kids – or maybe she has 7.5 million subscribers to her YouTube channel. How Hispanic stars are born on YouTube and create content for a global audience.

In the second article on Multichannel Networks (MCNs), Portada Digital Media Correspondent Susan Kuchinskas looks at how MCN’s gather the best of independent video programming, often being distributed via YouTube channels, and then play matchmaker between brands and individual content creators.

The Multichannel Network (MCN) World is smoking hot. YouTube content has grown up – so much so that it’s growing off the platform, thanks to multichannel networks, or MCNs, that are investing in original content and investigating new distribution channels. Is this the future of TV? What major players told Portada Digital Media Correspondent Susan Kuchinskas.

Spanish-language media company Televisa and MiTú , an Internet-media and digital platform company focused on Latino audiences, have signed a multiyear multiplatform deal, under which they will jointly develop and distribute original programming and formats and deliver more than 620 million videos per month.

The rise of YouTube and its attendant online celebrity millionaires has created new opportunities for venture investors to launch new marketing and advertising platforms.

The rise of YouTube and its attendant online celebrity millionaires has created new opportunities for venture investors to launch new marketing and advertising platforms.

MiTú, the Latino media brand and multi-channel network dedicated to Latino content, has announced it will partner with the National Association of Latino Independent Producers (NALIP). The alliance will allow organizations to cross promote and market each others’ services and programming while developing original content and new talent.

What: Multichannel Network MiTú has closed a licensing agreement with AOL to syndicate Hispanic video content over a wide array of AOL Hispanic digital properties. Why it