Three Tools to Help You Target Hispanics Via Mobile

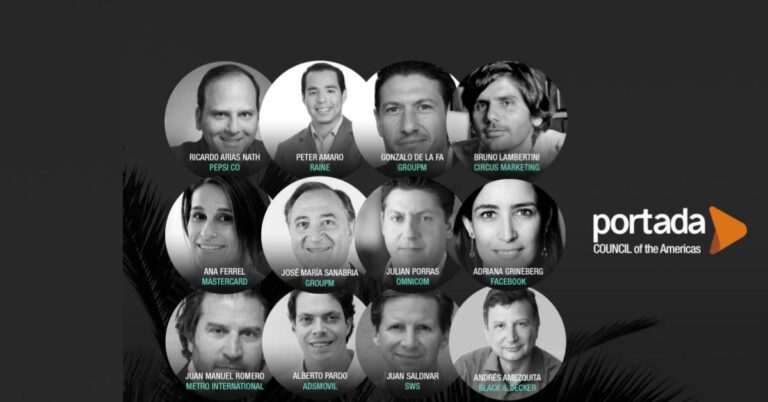

We talked to Adsmovil’s Alberto Pardo about the main challenges and recommendations to reach Hispanics effectively through mobile. Hispanics are a hugely important part of the U.S. population, and communicating successfully with them demands a holistic understanding of the consumer’s identity and behavior.