Following the introduction of marketing restrictions, including advertising bans, for alcohol, vitamin supplements and tobacco products and repeated calls to extend the legislation to more sectors, Brand Finance analyzed the potential impact of such policies on the food and drink industries’ brands.

Microsoft just updated its Audience Network policies. The company will no longer allow brands or companies to run ads related to health supplements and vitamins, gambling, lawsuits, and end-of-life products and services. Google prohibits adult content, alcohol, copyrights, gambling and games, healthcare and medicines, political content, financial services, and trademarks.

The latest Brand Finance Marketing Restrictions 2021 report – building on the analysis conducted in 2017 and 2019 – estimates potential loss to businesses at over US$500 billion and seeks to understand popular attitudes to brands and marketing restrictions thanks to insights from an original global consumer survey.

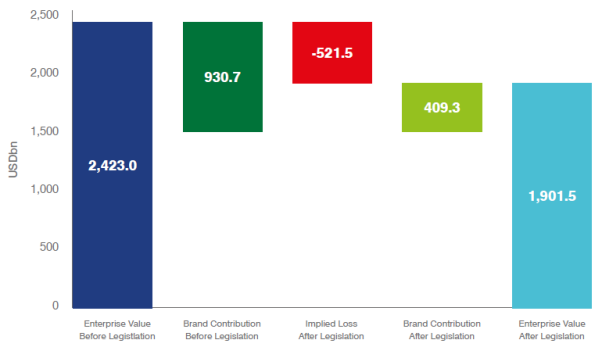

Over US$500 billion at risk

In the latest report, Brand Finance analyzed the potential damage across alcohol, confectionery, savoury snacks, and sugary drinks brands which can result from the imposition of marketing restrictions across the globe. The analysis models the impact on enterprise value from potential reduction in the added value that brands contribute to the business – known as brand contribution.

The report looks at nine of the world’s biggest food and drink brand-owning companies: AB InBev, The Coca-Cola Company, Diageo, Heineken, Mondelēz International, Nestlé, PepsiCo, Pernod Ricard, and Treasury Wine Estates, as well as the industry as a whole.

The nine major brand-owning companies could lose a total of US$267 billion in enterprise value should marketing restrictions be implemented. On average, the companies in question could each lose nearly a quarter of their enterprise value and over 50% of brand contribution.

Looking beyond simply the nine companies analyzed, and extrapolating this to the entire endangered industries globally, alcohol, confectionary, savoury snacks, and sugary drinks brands could lose a whopping US$521 billion.

David Haigh, Chairman and CEO of Brand Finance, commented:

Implied loss across food and drink industries if marketing restrictions imposed globally

Losses to soft drink giants

Given the importance of brand in the soft drink industry, imposing plain packaging or further limitations on advertising would cause severe damage. PepsiCo would lose the most in absolute terms among all companies studied, with a potential loss of nearly US$62 billion. PepsiCo’s flagship brand Pepsi is estimated to suffer the most within its portfolio, with US$23 billion at stake. However, The Coca-Cola Company’s flagship brand, Coca-Cola, would stand to lose US$43 billion – considerably more than bitter rival Pepsi and any other brand in the analysis. It constitutes the majority of the US$57 billion potential loss estimated for the company.

Top alcohol companies face 100% exposure

Alcoholic drinks giants, AB InBev, Heineken, Diageo, Pernod Ricard, and Treasury Wine Estates could face 100% revenue exposure should marketing restrictions be imposed on their sector on a global scale, due to their portfolios consisting entirely of products that would be affected by the legislation.

In relative terms, Treasury Wine Estates’ enterprise value would suffer the most compared to all companies analyzed, with the potential to lose a significant 38.9%. At the same time, in absolute terms, AB InBev would lose the most among alcohol corporations studied, with nearly US$40 billion of value at stake.

Global survey on attitudes to food and drink’ industries brands and marketing restrictions

Given the risks to brands from marketing restrictions, over 6,000 people were surveyed across 12 countries globally – including over 500 from the US – with respondents asked their opinions on brands and marketing restrictions.

Additionally, 13 CMOs, who are currently or who were recently overseeing brand marketing in leading organizations in the sectors covered in the research, were interviewed about the contribution that brands make to economic and social wellbeing, as well as their concerns about marketing restrictions.

American attitudes to brands

Globally, and across the US, the general public recognizes the positive impact of brands, both on their everyday lives, as well as on wider societies and economies. Over 85% of American respondents agree that brands encourage product quality, improve choice, and point out the role of brands in limiting illicit trade. At least three quarters of American respondents also recognize the positive impact of brands on the economy, job market, and the media industry.

Jane Reeve, Chief Communication Officer, Ferrari, commented:

Which of these impacts do you think brands provide or encourage?

Impact | Global | US |

Broader choice of products | 95% | 90% |

Product quality and safety | 93% | 86% |

I can buy genuine products in reputable stores | 90% | 86% |

Making a contribution to the economy | 89% | 80% |

Supporting media through advertising funding | 86% | 80% |

Good jobs in roles such as marketing, sales, advertising | 85% | 80% |

Encouraging better solutions for the environment | 81% | 74% |

Better treatment of suppliers | 80% | 71% |

Better treatment of employees | 77% | 71% |

High expectations that brands should be a force for good

Consumers expect brands to be a positive force in society. They do not want brands that are silent on the causes that matter to them and there is a general expectation that brands should be doing their part to support society. As such, 72% of American respondents expect brands to provide superior product safety and production standards and 69% expect brands to lead on equal treatment regardless of gender, race, and disabilities.

Doug Place, CMO, Nando’s – Africa, Middle East, South Asia, commented:

What do you expect from brands?

Impact | Global | US |

Superior product safety and production standards | 79% | 72% |

More ethical sourcing and supply chain | 74% | 63% |

Better employment practices than small businesses | 73% | 67% |

Leadership on equal treatment regardless of gender, race, disabilities, etc. | 72% | 69% |

Supporting charitable causes | 70% | 57% |

Leadership on waste reduction | 69% | 57% |

Little appetite for sweeping marketing restrictions

Both the general public and CMOs understand that brand benefits can only be delivered if brands can market themselves, from product quality control to the added value for society.

The survey shows that consumers do not generally seek curbs on the most frequent marketing channels, regardless of product category. Across the global sample, fewer than 10% of consumers felt that there should be a ban on TV advertising, billboards, in-store demonstrations, or distinctive packaging – with little variation across product categories.

Consumers are brand literate but will not forego their own interests under the influence of marketing and advertising. Consumers are aware that brands are there to help them make informed decisions.

Marketing restrictions in the food and drink industries aggravate the illicit trade problem

Marketers and consumers are wary of over-regulation, as marketing restrictions – in particular plain packaging – can facilitate fraud and present a danger to consumers.

Shiyan Jayaweera, Head of Marketing, Lion Brewery, commented:

Consumers emphatically acknowledge (80-90% agreement across markets analyzed) the role that brands play in supporting legal sales channels, as well as helping to navigate between real and fake goods – and this brand literacy helps explain why most accept that brands should be allowed to promote themselves in a responsible fashion.

View the full Brand Finance Marketing Restrictions 2021 report here