What: Who are brands turning to in order to engage today’s evolving Hispanic Marketing audiences? Are Univision and Telemundo still the go-to networks? How are budget allocations shifting as new platforms and media emerge? We talk to industry insiders to find out.

Why It Matters: While digital platforms allow for more effective targeting and messaging, Univision and Telemundo remain referential to Hispanic marketers. Their market share and consumer demographics resources make them pillars of Hispanic communication.

Evolving demographics and new digital platforms and formats are keeping marketers on their toes. But while online video and social media are extremely popular, some things don’t change. Networks Univision and Telemundo continue to wield considerable power in connecting brands with Hispanic audiences.

Telemundo, Univision: a source of knowledge about consumer demographics in Hispanic Marketing

Multicultural marketers watch Univision and Telemundo closely. The industry leaders are an example on how to keep up with the increasingly complex Hispanic demographic. In many ways, marketers are comfortable turning to them as safe bets for reaching and truly engaging Hispanic audiences. Chris Ota, Marketing Manager, Confections & Global Foods at Nestlé USA said that their Multicultural COE, led by Margie Bravo, “works very closely with Univision and Telemundo as they bring great resources and knowledge about with consumers demographics.”

Margie Bravo, Multicultural Marketing Manager at Nestlé USA explains how the two powerhouse networks have seen the shifting Hispanic Marketing landscape evolve. “They are adapting the offering for the future as they more than anyone has seen their audience evolve as well.”

Larissa Acosta, Segments Integrated Marketing Lead at Wells Fargo, agrees. “Latinos are an important consumer segment for Wells Fargo, which is why Univision and Telemundo are key partners in our marketing mix. They both target the same audiences with similar programming. We don’t see one network as more effective than the other.”

Too few marketers cater to Spanish-Speaking Hispanics

Lucia Ballas–Traynor, Executive Vice President, Client Partnerships at Hemisphere Group, supports both Ota and Acosta’s arguments in favor of Univision and Telemundo’s effectiveness. “Tell me what general market network can claim the type of share that Telemundo and Univision have. That’s what marketers and buyers should focus on,” she says.

She also explains what it means that Univision and Telemundo still hold such a high share of Hispanic audiences. “It means that regardless of acculturation level or language proficiency, Hispanics are still largely underserved by general market choices.”

English or Spanish. What difference does it make?

Regardless of which language Hispanics speak primarily, Spanish plays a key role in their identity. For this reason, “reaching ‘Spanish-language Hispanics’ is still a priority for a select group of marketers, but should be part of every marketer’s strategy,” adds Traynor.

Nonetheless, Morgan admitted that Univision and Telemundo are far more targeted to the bilingual or Spanish-dominant Latino. They “still don’t address the English dominant ones, as the majority of their programming (95%+) is Spanish-language.” As the Hispanic becomes more acculturated and bilingual, Morgan, at least, does not see them switching to English: “Their core business is Spanish-language television, so the story they tell in the marketplace speaks to that.”

Acosta of Wells Fargo seconds that sentiment, and adds: “Spanish language television has been delivering big ratings for a while now, so we are not surprised that the trend continues.” She also notes that much of the viewing for these networks is live, as streaming and time-delayed viewing become more common programming formats.

It’s complicated to address the Hispanic audience at the right level of inclusion. Marketers must understand that the Hispanic American today is complex. Bravo of Nestlé says that when Telemundo and Univisión started “[they] had a foreign-born population that didn’t speak English, but today the highest growth is coming from the second-generation of US-born Hispanics who are very proud of where they came from but want to also honor their American heritage.” For this reason, instead of focusing solely on Multicultural or Hispanics, many brands are opting for a Total Market approach.

More Brands Adopting ‘Total Market’ Approach

Nestlé is one of them. Their coffee Latino-oriented brands like La Lechera, Nescafé Clásico, and Coffee-mate communicate through both English and Spanish advertising. Bravo adds that “The Spanish creative may be slightly different to acknowledge the nuances of how the brand is viewed or used amongst Latinos.” However, a Total Market approach seems to facilitate more flexibility.

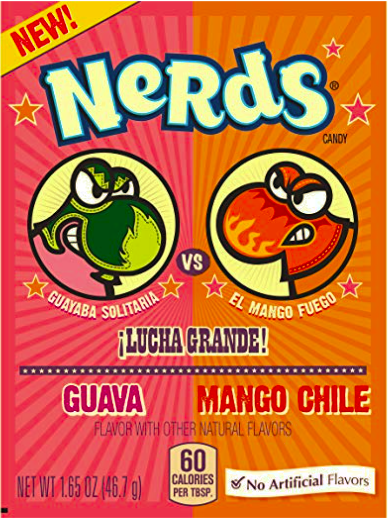

Bravo also mentions that Nestlé has introduced “exotic flavors inspired by Hispanic tastes across several categories,” like confections, frozen snacks, and beverages. For example, take the Nerds candy ¡Lucha Grande! campaign. “For Hispanics some of these flavors may be nostalgic. But for Non-Hispanic Millennials, these flavors may add a cool twist to their favorite Nerds candy,” says Bravo. And the industry recognized this effort, awarding it the National Confectioner Association’s (NCA) “Most Innovative 2017 New Product” award.

Are Facebook and Google alternatives to Univision and Telemundo?

So what about the alternatives to Univision and Telemundo? Asten Morgan, Executive Director of Integrated Media at Latina Media Ventures, said: “Univision and Telemundo are Spanish-language television networks,” says Asten Morgan, Executive Director of Integrated Media at Latina Media Ventures. “Facebook, Google and now possibly Snap have more influence specific to Latinos, [but] those networks have small digital footprints.”

On the other hand, Acosta noted that new digital platforms do offer opportunities that television does not. “New digital platforms have allowed our marketing messages to be more targeted, measurable and culturally relevant…We have opportunities to experiment with new creative and content formats and test our way into optimized creative that drives business results.”

Acosta adds: “Both networks have recognized that media consumption is changing. They’ve set very interesting strategies in play to evolve with the times.” By acquiring properties like Fusion, The Onion, and The Root, Univision’s strategy seems to target not just Hispanic, but Millennial audiences. Telemundo, on the other hand, promotes within NBC’s properties. “They are both important partners, and are among many other Hispanic targeted vehicles that are part of our media mix,” Acosta said.

Multicultural and Hispanic Marketing: different but the same?

While some people use the words “Multicultural” and “Hispanic” interchangeably, they most certainly do not mean the same thing. Still, many brand marketers do not have budgets for both types of targeting. Are media buyers and brand marketers starting to shift budgets away from Hispanic into broader Multicultural targeting?

Morgan of Latina Media Ventures asserts that he does see them as competing for budgets. “It’s about trying to tap into two buckets of money. Some brands just have one or the other, but it’s smart on their part if they can pull it off, as Multicultural blurs the color or ethnicity line.”

But Morgan does not believe that budgets will shift away from Hispanic to Multicultural. Hispanic “can be as specific as Spanish-language only. This means the exclusion of the fastest growing Hispanic segment, the acculturated Latino.” In his experience, “there are specific Hispanic initiatives and then there are Multicultural ones.”

Will both fuse? Will marketers have to choose?

Acosta of Wells Fargo agrees that both Multicultural and Hispanic marketing are evolving. This progress is thanks to demographic changes “combined with the growing influence of diverse cultures on the mainstream, particularly with younger, digital native generations.” She adds that they work closely with Association of National Advertisers, the Alliance for Inclusive & Multicultural Marketing, and other industry organizations “so that the work is reflective of the growing influence and acceptance of diverse insights in business planning.”

Acosta asserts that, at Wells Fargo, they do not see any demographics or audiences as competing for budget. Instead, they let “the business opportunity determine our segment strategies and budget allocations.” This means the company allocates budgets in segments that are driving business through studying campaign data and measuring performance. So, in the end, it always boils down to having the right data. It’s important to know your target in order to choose the right approach.