What: CommerceNext has published the results of a survey of 100 e-commerce decision-makers, meant to explore similarities and differences in the priorities of traditional and digital-first DTC brands.

Why it matters: The report is meant to be a benchmark that helps marketers evaluate their priorities in terms of how to distribute budget among different technologies and objectives.

E-commerce is unpredictable; it forces marketers to be on the lookout for what’s coming next and reacting if only a little bit late can turn out to be fatal. In order to be more ready, decision-makers have to decide what matters more in every step of their strategy, which means having to prioritize investments and objectives. With these challenges in mind, CommerceNext conducted a survey of 100 top marketing executives in traditional and digital-first direct-to-consumer brands.

E-commerce is unpredictable; it forces marketers to be on the lookout for what’s coming next and reacting if only a little bit late can turn out to be fatal. In order to be more ready, decision-makers have to decide what matters more in every step of their strategy, which means having to prioritize investments and objectives. With these challenges in mind, CommerceNext conducted a survey of 100 top marketing executives in traditional and digital-first direct-to-consumer brands.

The objective was to provide a useful benchmark for online retailers to measure their priorities and decide how to distribute budget in the most convenient way. According to the results, even though both traditional and digital-first online retailers point to an increase in marketing budget, digital-first brands are spending way more while also diversifying their strategies. Below are the key insights from the study, titled How Leading Retailers and DTC Brands Are Investing in Digital.

Which Investments Did Work in 2018?

In order to compete, marketers need to be quick to decide which investments can help them reach their objectives. According to the study, 65% of respondents said their 2019 e-commerce marketing budget increased over the previous year, while only 10% of marketers are reducing their budget. In 2018, the top marketing investment priorities were acquisition marketing (81%), retention and loyalty marketing (43%) and promotions (32%).

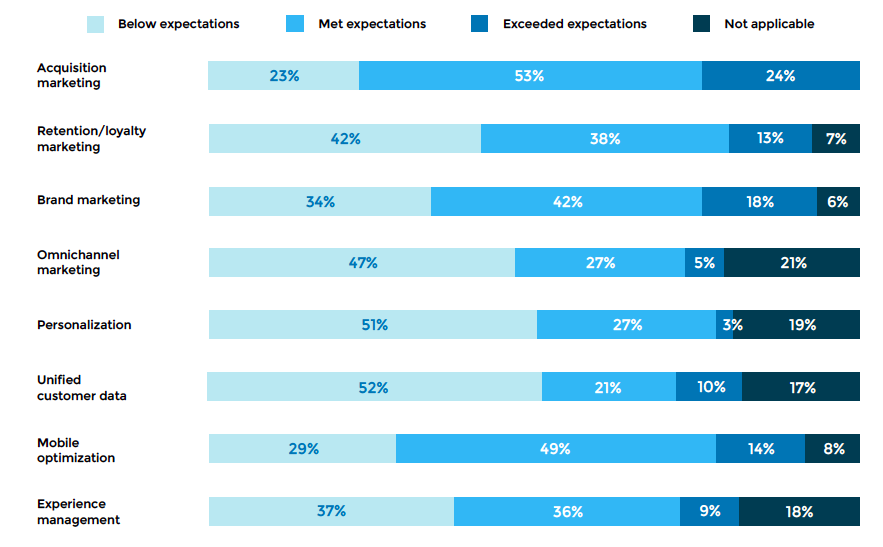

When asked about the results of those investments, acquisition marketing had the highest level of satisfaction rating: 53% of respondents said acquisition marketing met expectations in 2018, and 24% said it exceeded expectations. On the contrary, 52% of respondents said unified customer data (e.g. a single view of the customer) performed below their expectations. Almost the same number had similar levels of dissatisfaction in personalization investments (51%).

What Are the Priorities of Digital-First and Traditional Retailers?

According to the report, consumers have more than doubled the amount of time they spend on DTC brands’ websites over the last two years. Even though all the companies in the study have increased their e-commerce marketing budgets, digital-first DTC brands are spending more: 78% indicated that their 2019 budget is higher than the one they had in 2018, while 60% of traditional retailers said the same.

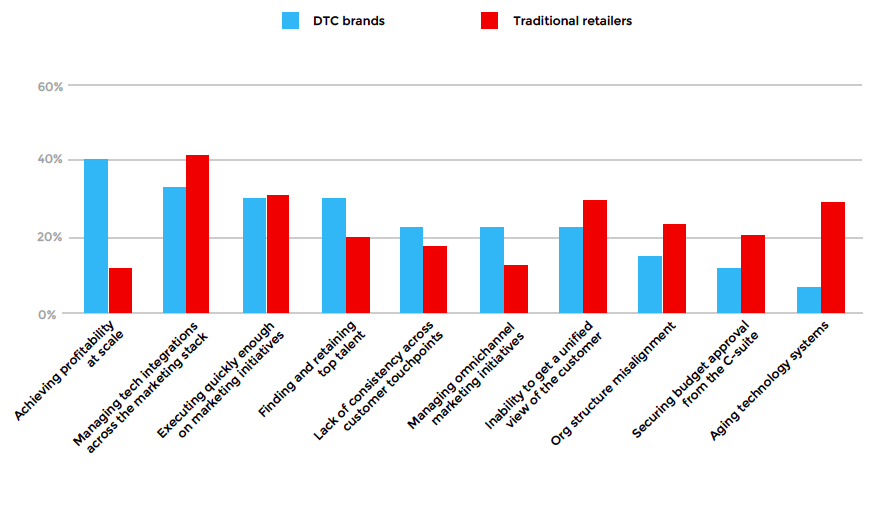

Because DTC brands are based on data-driven decisions and customer-centric operations, they are growing and evolving at an accelerated pace. As stated in the report: “fueled by venture capital investment, these brands have focused on growth vs profitability.” Therefore, the most significant challenge for this group of brands is “achieving profitability at scale”, with “Managing tech integrations” coming in second, with 33% of DTC brands identifying it as a barrier. This is a side-by-side comparison of what each group considers to be the most significant barriers, extracted from the study:

How to Make the Best of the 2019 Holiday Season

According to the NRF, the 2018 holiday retail season exceeded expectations. Over 165 million Americans reportedly shopped either in stores or online from Thanksgiving Day through Cyber Monday 2018, and online purchasing, in particular, experienced a 19% increase compared to the previous year. The NRF has forecasted that 2019 retail sales will increase by 3.8% compared to 2018, and the online sales growth rate will increase between 10% to 12%.

DTC brands are increasing their budgets at a higher rate than traditional retailers and spreading that budget more evenly. For example, digital-first DTC brands are increasing their budgets equally (70%) between acquisition marketing and retention/loyalty marketing. On the other hand, traditional retailers are emphasizing acquisition marketing, with 77% of respondents increasing their acquisition budget compared to 64% of traditional retailers increasing their retention budget.

[ctalatamb_es]

All images by CommerceNext.