Mexico’s Advertising market may be facing significant changes. E-commerce is one of the primary growth factors for the Mexican and Latin American advertising markets. Portada estimates that the advertising market aimed at promoting e-commerce will reach a volume of US $10 billion in 2025 in Latin America (out of approximately US $30 billion in total). Regulatory impacts, such as the Mexican Competition Regulatory Commission’s recent call to attention to Amazon and Mercado Libre, will have a significant influence on the evolution of the e-commerce-oriented advertising market (retail media advertising), e-commerce-oriented advertising alternatives (D2C and App), and marketing investments aimed at more efficient e-commerce (CRMs, etc.). Here, we point out three factors that the wake-up call could impact:

The Issue: Mexican Competition Regulatory Commission vs. Amazon and Mercado Libre

On February 13, 2024 the Mexican Competition Regulatory Commission (Cofece) published a preliminary statement from an internal commission about its investigation into Mexico’s retail electronic commerce market. It reported that “there are no conditions of efficient competition in the Mexican retail electronic commerce market (marketplaces). This market has grown significantly since the beginning of the Covid-19 pandemic, as more consumers use e-commerce to purchase goods or services.”

The text argues that “e-commerce is key so that small and medium-sized businesses can offer their products to more consumers.” According to the preliminary statement of the regulatory body (which we present in detail below), the two dominant e-commerce platforms must “disassociate memberships from streaming services, as well as any other service not related to the use of the marketplace.”

“The two dominant e-commerce platforms must disassociate memberships from streaming services, as well as any other services not related to the use of the marketplace.”

However, this decision would benefit small e-commerce businesses and perhaps help advertising services such as those offered by linear television or pure play CTV companies, delaying the consolidation in Mexico’s advertising market of a business model that dominant companies (e.g. Amazon and Mercado Libre) are driving. These dominant players include leading e-commerce sites such as Amazon and Mercado Libre, which offer highly targeted advertising services by collecting data from users of their e-commerce and streaming platforms, as they usually have both (such as Amazon with Prime Video and Mercado Libre with Meli+). The rationale behind Walmart’s recent acquisition of Vizio can be explained similarly. The recently issued opinion by the Mexican Competition Regulatory Commission is preliminary and now will be subject to debate in a plenary session of the organization. In any case, it is a wake-up call for major e-commerce players like Amazon and Mercado Libre. What impact would a regulatory crackdown of these and other players by the Cofece have on the Mexican advertising market? Let’s analyze.

Mexico Advertising Market: What Impact Would a Regulatory Crackdown Have?

According to data collected in the Portada Insights report “Electronic Commerce Marketing in Latin America,” the Latin American e-commerce marketing market is estimated to have a sales volume of more than US $10 billion by 2025.

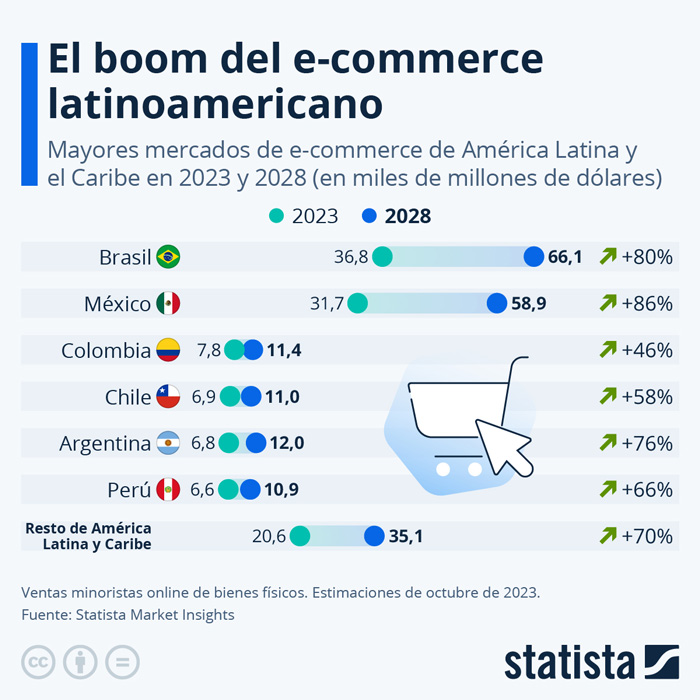

A study by the Tekios site states that: “Mexico is one of the main e-commerce markets in Latin America since, in 2023, it was estimated that more than 54% of the Mexican population acquired goods or services online.” Finally, Statista projects that Mexico and Brazil will be the countries in the region with the highest e-commerce growth by 2028.

With a market of that size at stake, Portada sought out Cristian Figoli, Chief Product Officer LATAM at Dentsu International, who gave us an assessment of how Cofece’s preliminary statement and potential follow-through could impact (or not) Mexico’s advertising market.

Figoli said to Portada: “These measures try to mitigate the hook effect that makes users subscribe to the loyalty and benefits plan of the leading companies in the marketplace, and that brings extra benefits and in turn helps feed the flywheel of use of the platform. I believe that the growth of other alternatives depends more on the growth that they can achieve geographically, scope of products and opportunities, and other factors that go beyond cutting this cross-platform benefit.”

1. They Are Great Because They Are Good

According to Figoli’s assessment, growth depends more on the platforms themselves than on eliminating competitors’ advantages.

Figoli continues: “The phenomenon of marketplaces and aggregators occurs in multiple industries and is a clear trend in different latitudes, especially in mass generalist commerce. This will also depend strongly on the product suppliers and resellers since in many cases they are obliged to be present on the platforms to achieve a sales volume, even when the percentages that the marketplaces keep are higher than expected.”

2. Mexico Advertising Market: CTV Pure Plays, such as Netflix and Disney Plus, May Benefit

A question that has arisen upon learning about Cofece’s wake-up call, the preliminary statement issued a few weeks ago, is whether it will benefit the giant Netflix by depriving Amazon and Mercado Libre of operating their Prime Video and Meli+ streaming services.

On this topic, Figoli maintains that Netflix’s position in the market is such that it won’t grow significantly because of any weakness of its competition. Still, it would imply that households modify their budget planning a little: “In the case of Netflix, which is undoubtedly the streaming service by definition and the one that is permanently present in homes, I believe that its position is already well established and in any case, based on this reality, there will be people who may decide to maintain a paid service and then move to the lower-cost, ad-supported versions of others.”

Netflix’s position in the market is such that it won’t grow significantly because of any weakness of its competition.

In addition, some services could use strategies already tested even by Netflix: “Given that most (or all) streaming services are moving to plans with ads, then surely Amazon can make use of that option when Prime Video launches in Mexico this year, although you will probably have to decide the price, since in those markets where the plan without ads is present it has an extra to the cost it already had, while Netflix decided at the time to establish the plan with advertising at a lower cost.”

3 The Full Funnel Advertising Channel Is Destined to Grow, the Question Is How Much

Cofece would be limiting a business model gaining traction worldwide. Companies like Amazon and Mercado Libre offer a platform for selling the product and advertising windows to advertise it. This enables them to provide advertisers with highly targeted programs and competitive conversion rates. Whether they can do this in Mexico’s advertising market, depends on regulatory developments led by Cofece.

Since the end of 2023, Amazon has refined the advertising offering for the ad-supported version of Prime Video, which has not yet arrived in Mexico. As reported by EcommerceNews: “Amazon has signed a three-year agreement with IPG MediaBrands, which will allow brands to connect with relevant audiences through Prime Video ads when Prime Video television shows and movies begin to include ads limited to early 2024. IPG Mediabrands is the first media holding company to partner with Amazon Ads on this new offering. As the company reported in a statement, Prime Video ads will initially launch in the United States, the United Kingdom, Germany and Canada, and later in the year in Spain, France, Italy, Mexico and Australia. IPG Mediabrands will support all these countries in 2024.”

In summary, two pathways for the development of Mexico’s advertising market may unfold:

- The Cofece ratifies the preliminary statement, thereby delaying the consolidation of the advertising model specified above, giving a little more time for the advertising model of linear television and similar platforms to thrive/survive.

- If the preliminary ruling is not accepted in Cofece’s plenary session, players like Amazon, Mercado Libre, and Walmart can offer advertising options, including ad-supported streaming, and the growth of the full funnel advertising channel model will accelerate.