What: The market for online grocery sales and home delivery is in its infancy in Mexico but offers huge potential given the 65 million Mexicans who now have access to the internet.

Why it matters: Grocery and general merchandise retailer Walmart has 4.5 million e-commerce customers in Mexico, and its competitors, like E-commerce Director Rafael Castelltort at Soriana, tell Portada how they are racing to sell groceries online, building new digital infrastructure, deploying machine learning, creating alternatives to credit card payments and launching websites highly customized for e-commerce and home deliveries.

Mexico may offer the perfect storm for selling groceries online. A rapidly growing urban middle class, internet penetration that now reaches 65 million, and grocery retail chains building sophisticated online payment and delivery infrastructures combine to make a bright future with huge potential, according to analysts.

“Supermarket chains in Mexico can grow tremendously in the future,” concludes a new study by the American media measurement and analytics company comScore. “The sector has huge potential for growth.”

Walmart leads the online grocery market with 4.5 million ecommerce shoppers in Mexico. Grocery chain Soriana comes next at 1.1 million, followed by Superama with 992,000. But while most Mexicans shop online using their mobile phones, online grocery shoppers still tend to use PCs more than any other device.

Many retailers now offer their own mobile applications, but the majority of online grocery shoppers in Mexico use a cell phone and rely on the cell phone’s internet browser instead of the retailer’s mobile application.

“Consumption by applications is still very incipient,” the study notes. Walmart’s online shoppers use its application only 25% of the time, while Soriana shoppers use Soriana’s application 15% of the time, according to the study shared by comScore with Portada.

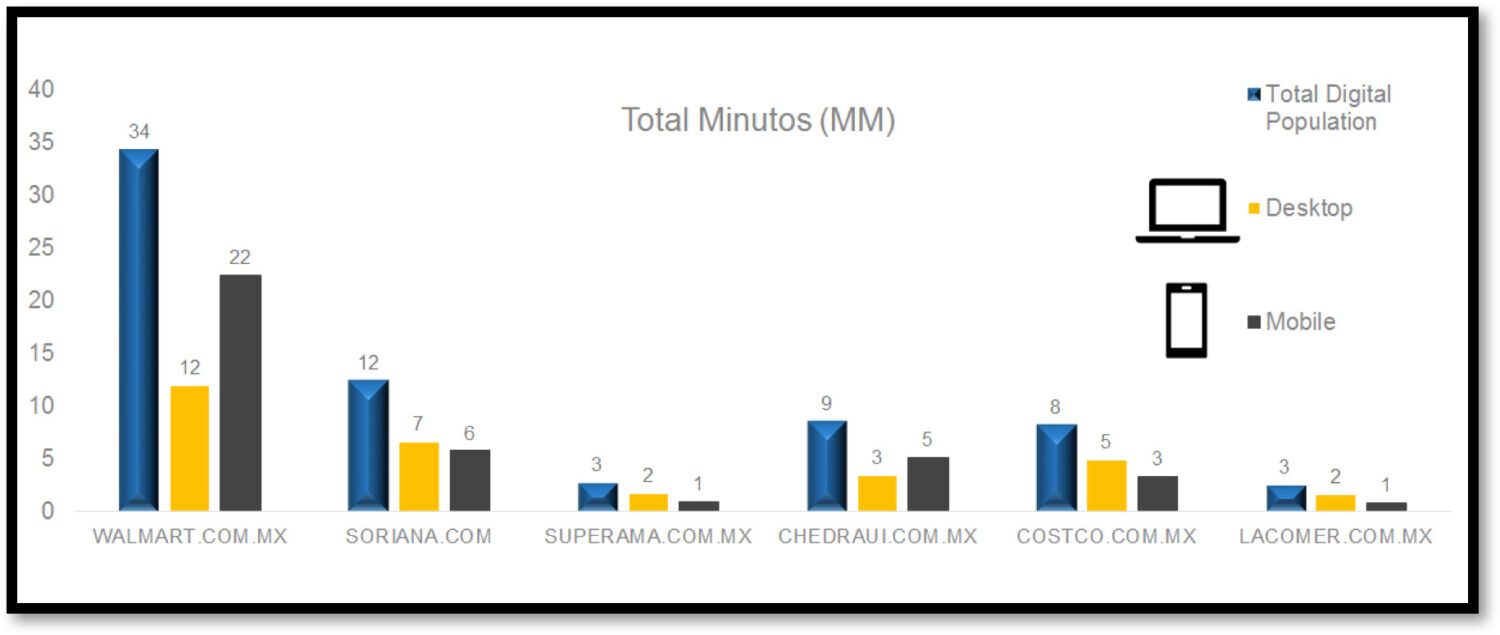

Surprisingly, when it comes to time spent shopping online for groceries, the PC is king, with the exception of Walmart and Chedraui. More ecommerce shoppers at Walmart and Chedraui use their mobile devices than the PC.

Source: comScore

In Search of Younger Online Grocery Shoppers

All of the grocery chains chasing the ecommerce market face the challenge of winning over younger shoppers.

Adults over the age of 35 are more likely to shop for food online than any other age group. La Comer, however, has the largest group of online shoppers ages 25 to 34, compared to all grocery retailers, the comScore study found.

Women make up the majority of online grocery shoppers at Soriana, La Comer and Superama, while men dominate at Walmart, Costco and Chedraui.

“The majority of our clients are women who value their time and value home delivery,” Rafael Castelltort, Director of Electronic Commerce at Soriana, tells Portada.

E-commerce shoppers have the option to pick their orders up at the stores, but home delivery is more popular.

Excellence in service is a pillar of Soriana’s strategy for winning over e-commerce customers. “We focus on the customer, deliver what they request, and in the time promised,” says Castelltort.

Excellence in service is a pillar of Soriana’s strategy for winning over e-commerce customers. “We focus on the customer, deliver what they request, and in the time promised,” says Castelltort.

Soriana does not offer lower prices online than in stores to win over new ecommerce customers. The average weekly order is between 50-60 items and customers can pay for the delivery using PayPal, by paying cash to the delivery person or swiping a credit card on a mobile terminal the delivery person brings with the order. Customers don’t have to pay online with a credit card to make a purchase.

Service, Service, Service

A totally seamless purchasing process, from order to payment and delivery is Walmart’s mantra for winning the battle of online sales.

“We understand that customers aren’t only looking to save money, but are also looking to save time,” Roberto Villalobos, Director of Web Operations at Walmart and Superama tells Portada.

“We understand that customers aren’t only looking to save money, but are also looking to save time,” Roberto Villalobos, Director of Web Operations at Walmart and Superama tells Portada.

“We are constantly improving the online shopping experience for our customers and have implemented significant changes for grocery shopping on our internet site, including our own mobile application.”

Walmart’s mobile application received the Best App award at eShow Mexico last year, Villalobos notes.

Challenges Ahead

Online grocery revenue in the U.S. reached $17.5 billion in 2018 and is expected to reach $30 billion by 2021.

In Mexico, however, the comScore study found uneven growth over the past few years, and a slight downward trend for 2019. Long delivery times may explain both factors, the study said.

And while the online grocery sale market has “huge potential” in Mexico, the comScore study finds significant challenges remain on the horizon, including the need to incorporate machine learning, big data, and logistics which have proven key factors for success in other parts of the world.

“With sophisticated technology and offers oriented to the user, Mexican grocery chains can grow greatly in the future,” the comScore study concludes.

In Part Two of our series on e-commerce grocery sales in Mexico, we explore specific marketing innovation, payment, and technology strategies being used to win the battle to increase market share.

[ctalatamb]