What: BrandZ, WPP and Kantar have released their annual report of the top 50 more valuable brands in Latin America.

Why it matters: Mexico is home to more of the most valuable brands than any other Latin American country.

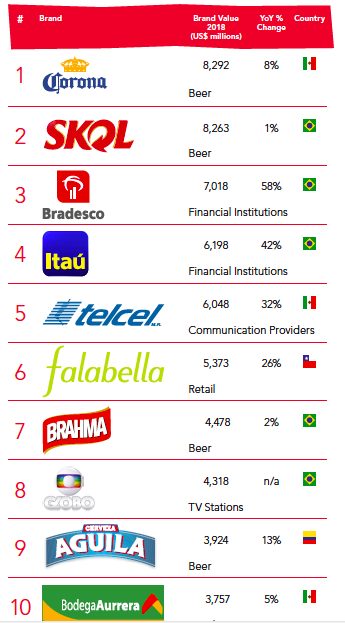

According to the sixth annual BrandZ Top 50 Most Valuable Latin American Brands report, Mexican beer Corona, with an 8% brand value growth, has edged out Skol, which grew by just 1%. Corona is sold in more than 180 countries.

The 2017 BrandZ LatAm ranking, based on Kantar data, shows the difficult time faced by many brands in the region with a 22% decline in total brand value. In the 2018 ranking, total brand value increased by 18% to US $130.8 billion, boosted by an impressive performance from the strongest and healthiest brands, those that believed in their purpose and stayed relevant to the consumers.

“The power of strong brands to drive improved business performance can be clearly seen in this year’s Latin America Ranking. While the economy may fluctuate, those brands that are strong will remain more stable in the tough times and grow faster in the good times,” said WPP’s David Roth in a press release.

The BrandZ™ Top 10 Most Valuable Latin American Brands 2018

This year’s BrandZ Latin American ranking shows a strong performance for local financial institutions (up 46%) and the four beer brands in the Top 10, controlled by global giants –Corona, Skol, Brahma (all AB InBev) and Aguila (Heineken)– have maintained and invested in their local characteristics enabling them to boost brand value.

“Latin American brands have an in-depth understanding of their local consumers; the speed at which they can tap into local consumers’ needs with good products and strong marketing campaigns has made many of them more successful and relevant in the region than their global counterparts. As a result, Latin Americans have great respect and pride in these brands,” said Kantar’s Eduardo Tomiya.

Other key trends identified in the BrandZ™ LatAm Top 50 study include:

- There were eight new entries in the Top 50 this year: Globo (no. 8), Ypé (no. 33), Azteca (no. 37), Embratel (no. 40), Lojas Americanas (no. 46), Net (no. 48) and Porto Seguro (no. 50). All are from Brazil, except Azteca which is based in Mexico. Communications provider Tigo Une was formed from the merger of Tigo and Une in Colombia, which were previously listed separately, and is now No 27.

- Mexico dominates but Brazil is catching up: For the fifth year the ranking was dominated by Mexico, which contributed 35% of the total brand value of the ranking. Brazil however was close behind at 34%, with strong performances by its retail and financial players. Chile was in third position at 16%, followed by Colombia at 7%.

- FinTechs threaten established financial players: In Brazil, Nubank started this revolution and became the first billion-dollar startup in the country, followed by Banco Original and Banco Neon. Well-positioned brands such as the Brazilian banks Bradesco and Itaú and the Chilean bank Banco de Chile are still strong brands in the consumers’ minds and are using these attributes aligned with local needs to fight back by launching their own digital platforms.

- E-commerce is a real threat to established retail: Rising internet usage and mobile access in many markets, up 14% every year across the region since 2010, represents a real threat to bricks and mortar stores. While the Retail category saw growth of 2% in this year’s ranking, the transition to a mixed retail economy is still in progress.

“Disruption has already spawned a new wave of brands across Latin America and while they have not yet displaced some of the more established names, rising internet access, and mobile uptake is giving them greater market access. The power of a strong brand combined with its own digital platform will be required to future proof many of today’s big players,” said Kantar’s Gabriel Castellanos.

[ctalatinb]