By Gabriela Gutiérrez M.

YouTube has more viewers, but Twitch generates better profits.

The world’s 665 million viewers of gaming video content (GVC) exceed the total population of the United States and Mexico together. This explains how this industry is able to generate profits of US $4.6 billion, according to digital gaming market researcher SuperData Research.

YouTube Gaming and Twitch (bought by Amazon in 2014 for US $970 million) are the two platforms that dominate the eSports broadcasting market. However, although YouTube has more viewers, Twitch is making bigger profits. According to SuperData, the eSports platform captures only 16 percent of the audience but earns 37 percent of its revenue from gaming video content. This is mainly due to the direct income it receives through subscriptions.

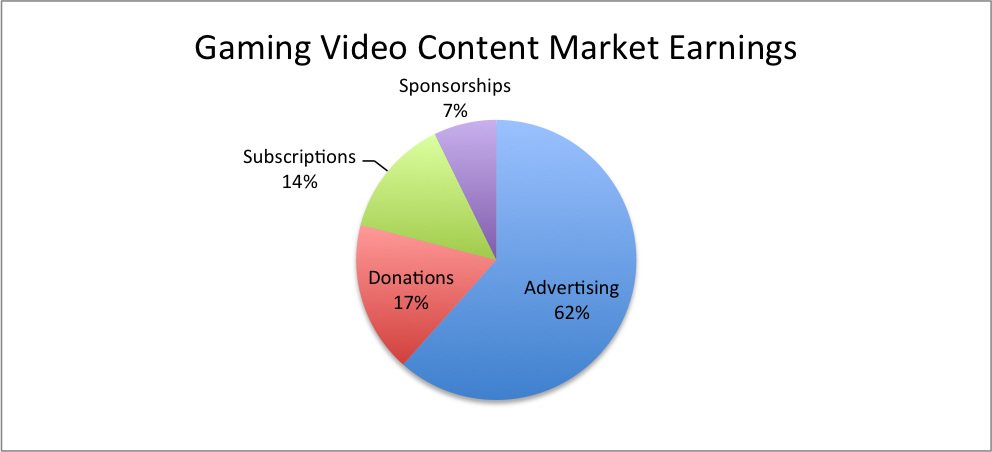

Within the industry, brands and advertisers add US $3.129 billion to the gaming video content market, while subscriptions and donations generate US $1.418 billion. Alejandro Leyva, alias Alk4pon3, one of Mexico’s most important eSports influencers, says that it is easier for him to position the brands through Twitch since the network reaches a market whose average age is 21; unlike YouTube, where the market age drops to teenagers, who have lower purchasing power.

In addition, “Twitch is fairer with content creators,” says Alk4pon3. “When you’re broadcasting, and an event song starts playing in the background, YouTube takes a portion of your revenue to give to the owners of the song, whereas Twitch blocks the sound.”

“Gaming video content represents a highly desirable marketplace for advertisers, due to the fact that its audience is young, tech savvy and willing to spend money,” states Carter Rogers, Research Manager at SuperData Research.

SuperData’s research concludes that men make up 54% of the gaming video content audience, with women comprising the remaining 46%. In addition, gamers who like to watch gaming related videos spend an average of US $70 on games and content, or 56% more than gamers who do not consume videos.

“Companies that do not advertise to GVC viewers risk losing potential customers, as they resort to legacy media streams. With a global audience that reaches more viewers than HBO, Netflix, ESPN and Hulu combined, brands may be missing out on the next prime-time viewing activity, not unlike watching television or sports during peak viewing hours,” adds Rogers.

[ctahfb]