OTT Networks like Netflix and Hulu don’t share their data with anyone, David Wiesenfeld, Chief Strategist at Truoptik, a data driven millennial audience and consumer monetization company tells Portada. “Netflix in particular won’t even share viewership numbers for a movie or TV show with the company that licensed them the content. So the data is “walled off” from the industry,” says Wiesenfeld. No wonder that content producers don’t like this. Mexico’s Televisa, for example just announced that it will take off all its content from Netflix at the end of 2016 to launch its own OTT service Blim.

For sure, Netflix and other major OTT networks use the data in-house (e.g. Netflix has created micro-genres to better target prospective viewers). But what about the data coming from OTT streams, the vast majority that are not published branded content networks like Netflix and Hulu? The recently announced partnership between TruOptik and media agency Mindshare pretends to provide an answer. Both companies joined forces to parse television and movie content into behavior-based “micro-genre” graphs that will enable media companies to market content with precision to consumers in more than 150 countries.

“The real valuable data and insight in the OTT ecosystem resides in walled gardens,” says Andre Swanston, CEO of Tru Optik. “Tru Optik’s mission is to organize and activate OTT’s big data’ so media companies can create compelling content and power more effective advertising. The collaboration with Mindshare to create micro-genre graphs achieves this mission.”

Anonymized Information on more than 500 million consumers…

TruOptik’s and Mindshare”s Micro Genre graph will be able to leverage the world’s largest database of professional media consumption containing anonymized information on more than 500 million consumers (about seven times the number of Netflix subscribers). It consists of over 20 million movie, TV, music, and video game pieces of content. While other companies, like Netflix, have created micro-genres, they have done so with a significantly smaller audience size and title pool. It will be deployed by Mindshare in The Loop, the agency’s proprietary data visualization and communication layer focused on faster and better decision-making.

TruOptik’s and Mindshare”s Micro Genre graph will be able to leverage the world’s largest database of professional media consumption containing anonymized information on more than 500 million consumers (about seven times the number of Netflix subscribers). It consists of over 20 million movie, TV, music, and video game pieces of content. While other companies, like Netflix, have created micro-genres, they have done so with a significantly smaller audience size and title pool. It will be deployed by Mindshare in The Loop, the agency’s proprietary data visualization and communication layer focused on faster and better decision-making.

…for Entertainment Companies to Monetize

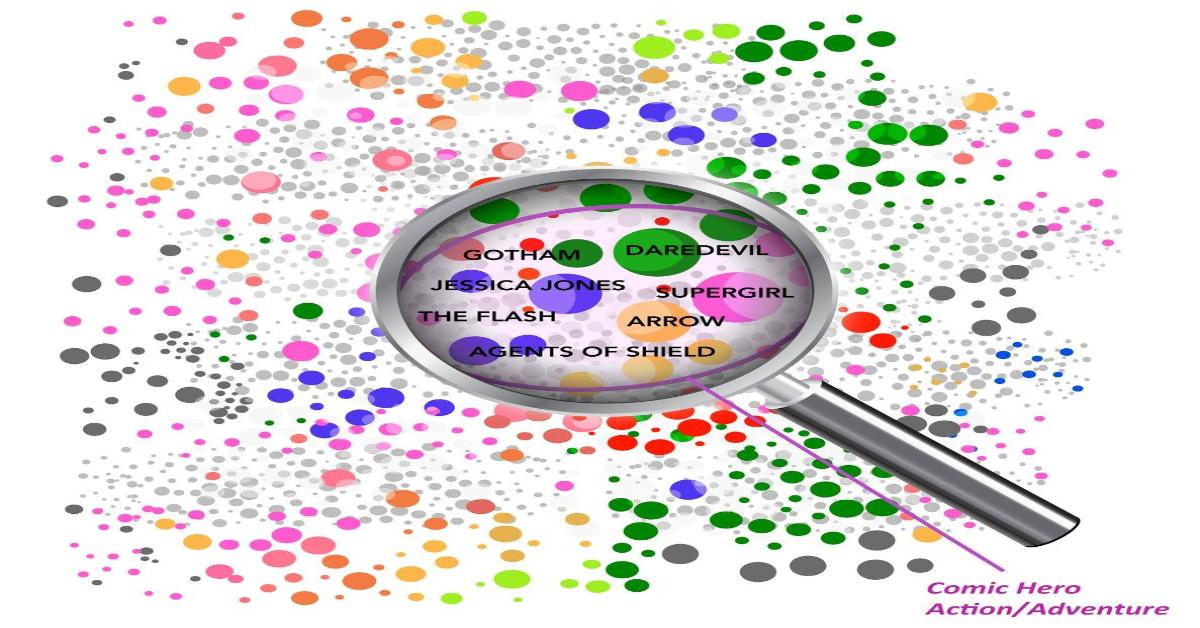

Basic contextual and geo targeting is no longer sufficient for entertainment companies to monetize their portfolios or inform promotion of specific titles. Micro-genre graphs organize titles into small clusters based on their tendency to be watched by the same consumers. For example, if ‘deadpan comedies with female leads’ and ‘female relationship comedies’ appeal to different audiences, media companies need to know, and micro-genre graphs provide that insight.

Wiesenfield notes that TruOptik and Mindshare “track downloads and streams on consumer supported digital file-sharing exchanges, which are the world’s first and largest OTT Networks, Available content dwarfs the library for Netflix or any other branded OTT network, pretty much every TV show or movie is available pretty much everywhere from the moment it is released. That means media companies can understand demand for their content in countries before it is released.

U.S. Hispanic Application

When it particularly comes to target Hispanic and Latin American audiences, what are the advantages of “micro graphs” versus other tools? There are quite a few, says TruOptik’s Wiesenfeld. The micro-genre graphs would allow an in-depth understanding of both the popularity of genres among Hispanic segments as well as how Hispanics segments tend to group content relative to the population as a whole and relative to each other.

“A simple example would be that Telenovelas don’t even exist as a genre for non-Hispanics in the U.S., but we would expect to find numerous telenovela micro genres among U.S. Hispanics. The really powerful ability would be to understand how genre popularity and groupings differ among different segments of the Hispanic population, based on the factors such as country of origin, degree of acculturation (for U.S.. Hispanic residents), age, gender and so on. This could provide new insight into persistent questions regarding Hispanic content consumption, such as English vs. Spanish Language preference (how does this vary across Hispanic segments? across genres), in what ways are second/third generation Hispanic media patterns different from the general population etc…”

[ctahfb]