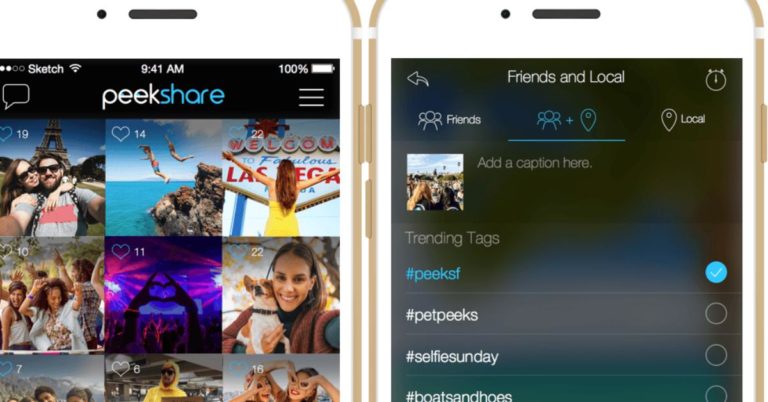

Peekshare Bringing Disappearing Photo Sharing to LatAm Mobile Market

San Francisco based social media platform Peekshare is bringing disappearing photo sharing to the rapidly growing mobile market in Latin America through an app.The company is officially making the app available on the Play Store next week and is preparing for a major marketing push by the end of the month.