MASS Exchange Helps Mundial Sports Network Manage Complexity of Media Trading at Scale

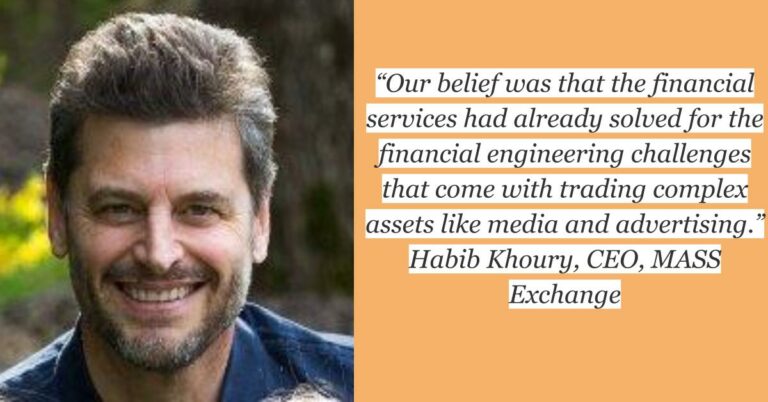

Habib Khoury, CEO at MASS Exchange, explains how his company applies a financial model to a complex industry plagued by a lack of transparency.

Habib Khoury, CEO at MASS Exchange, explains how his company applies a financial model to a complex industry plagued by a lack of transparency.

Mundial Sports Network, a leading Latino sports network with magazines like Futbol and Beisbol as well as digital properties like FutbolMundial.com, BeisbolMundial.com and BoxeoMundial.com, and YipTV, a live Internet TV platform that specializes in providing affordable, real-time content for Latinos, have a common goal: connecting underserved Hispanic audiences with the content they want.

There were many news last week at the NewFronts, the weeklong series of presentations from digital content powerhouses in New York City. The focus on Spanish-speaking