Impremedia Launches ‘Solo Dinero’ for the Hispanic Community

Impremedia, the leading Hispanic news and information company, launches Solo Dinero, the only digital publication on personal finance in Spanish, aimed at the Hispanic community

Impremedia, the leading Hispanic news and information company, launches Solo Dinero, the only digital publication on personal finance in Spanish, aimed at the Hispanic community

People change positions, get promoted or move to other companies. Portada is here to tell you about it.

The TV market is heavily concentrated; the top seven media owners account for 84% of ad spend season-to-date. Through April 2019, upfront revenue is down 0.5% annually. On a two-year basis, upfront revenue was down 3.6% on an average weekly basis.

Habib Khoury, CEO at MASS Exchange, explains how his company applies a financial model to a complex industry plagued by a lack of transparency.

WPP’s MEC is car rental company Hertz new media agency of record in the US, Canada and Latin America.

MEC will replace incumbent agency Florida-based FKQ Advertising.

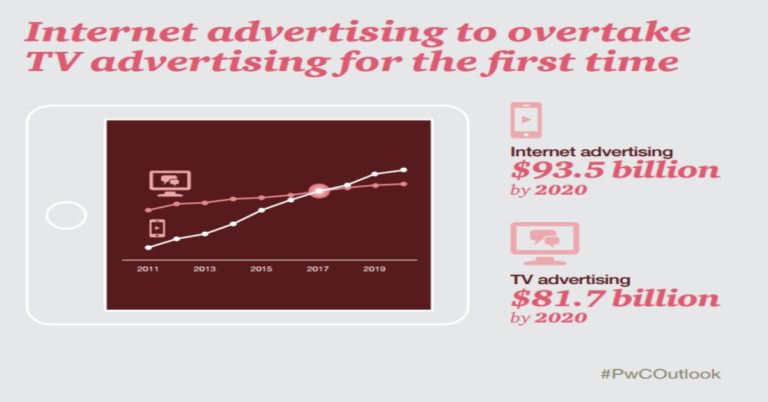

Entertainment and media spending will hit US$720 billion by 2020, up from US$603 billion in 2015, while internet advertising will overtake broadcast advertising in the U.S. for the first time, according to the finding from PwC’s annual Global Entertainment and Media Outlook report, the company’s five-year economic forecast for media and entertainment industry revenue and ad spending.

ImpreMedia announces the creation of IM Studio ñ, its in-house marketing solutions service provider.

What: Visa has picked Publicis Groupe’s Starcom to be its global media agency of record. Why it matters: Starcom will provide Visa with a fully integrated offering

What: Telecom Giant Altice has acquired Cablevision in a US$9 billion deal. Why it matters: Altice will inherit 2.78 million broadband customers and 2.64 million pay-TV

The Wall Street Journal is rolling out its first mobile-only product, a paid, digest-style news app that consolidates digital and reconfigures its newsroom through staff buyouts.

What: Wells Fargo has shifted its Media and Digital Business after a review that started in February and has not yet been finalized. OMD will pick up