ANA’s New Alliance Helps Step Up Game in Multicultural Marketing

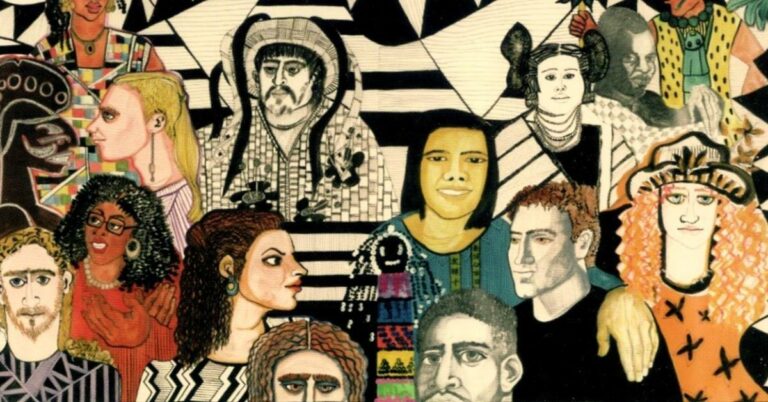

We caught up with industry pioneer Rochelle Newman-Carrasco of Walton Isaacson at the ANA Multicultural Conference and asked her a few questions about the growing momentum of The Alliance of Multicultural Marketing (AIMM).