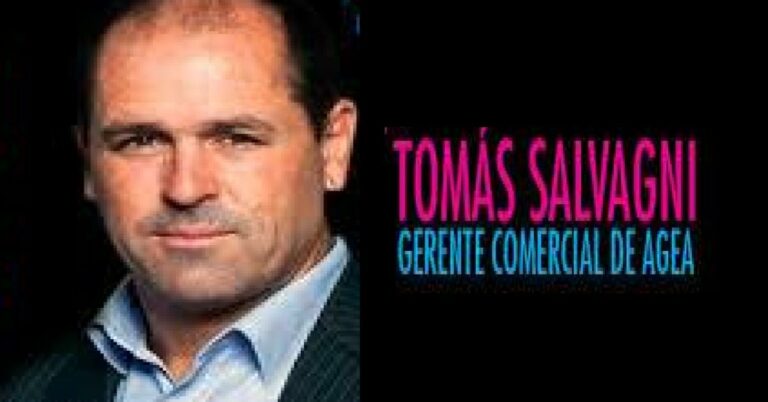

Marketing and Media Sector Mourns the Death of Tomás Salvagni

Thomas Salvagni, Commercial Manager at Grupo Clarin’s AGEA died suddenly last wednesday November 16 due to a cardiorespiratory failure. He was in Mar del Plata (Argentina), where Clarin’s Commercial Division was having a meeting.