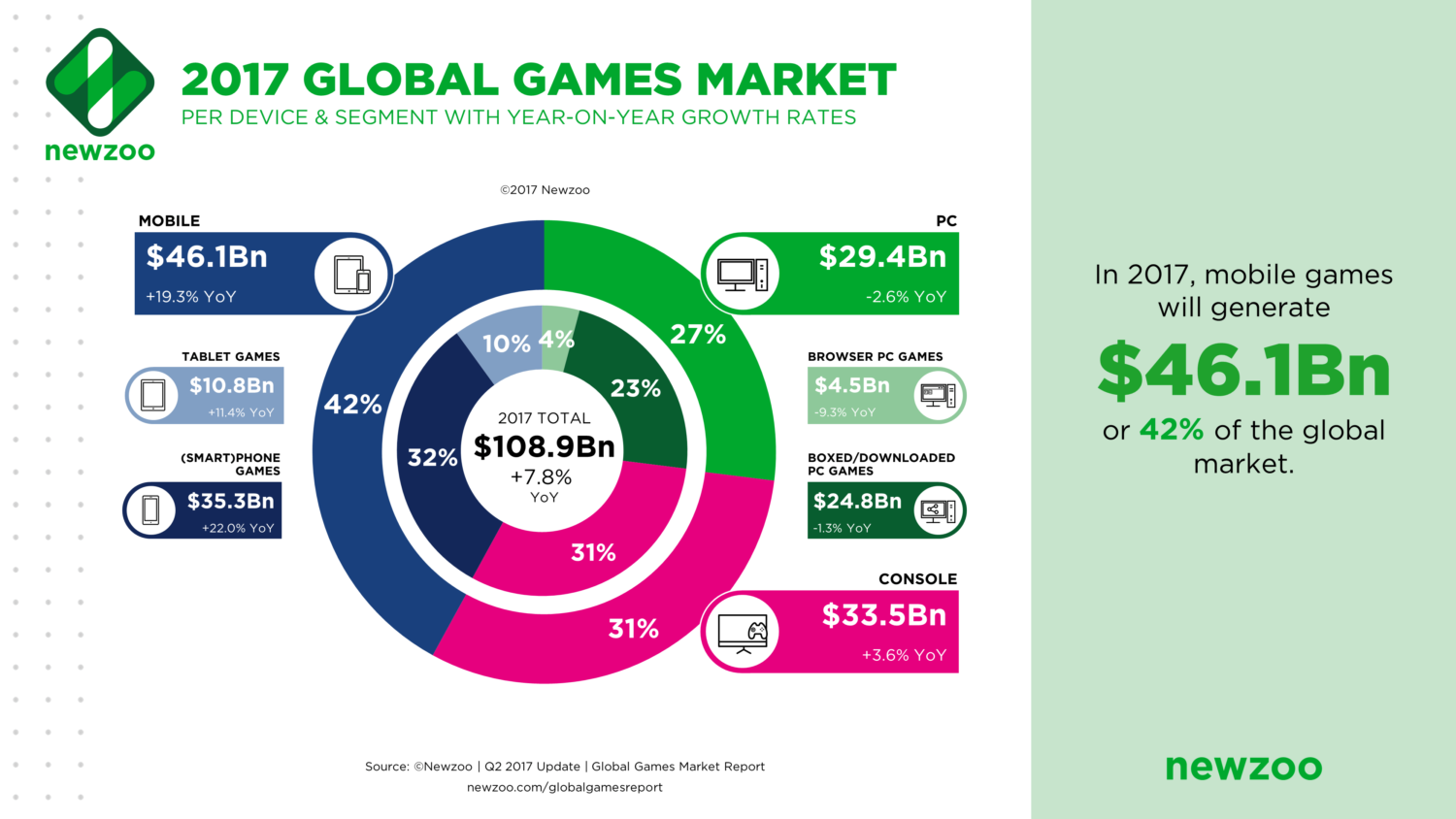

The launch of Games4U is part of Vivo‘s strategy in a very promising enterprise: Brazil is the 13th largest game market in the world and mobile gaming is the fastest growing segment, claiming 42% of the global gaming market.

By Carla Ponte, with Luiz Duarte.

There is a global population of 2.2 billion gamers, or should we say “game enthusiasts?” According to Newzoo’s 2017 Global Games Market Report, this is a more accurate term as this planetary crowd includes a much wider variety of interests: playing intensely, casually, professionally; viewing game content on-demand and live streaming; following the news and championships worldwide or just engaging in so many other innovative practices we cannot even imagine today, but will soon see. The fact is, digital games are rapidly becoming the world’s favorite pastime.

Vivo Games4U wants to be the digital platform of choice for these consumers in Brazil. The service is accessible through Android apps by any mobile user, with added exclusive premium content for Vivo subscribers. Besides access to over 300 games, the digital platform offers information about the main games on the market, trailers for new games, and news coverage about games and sports events along with all sorts of content regarding the topic. “Our strategy is to be closer to this audience, understand their demands and contribute to strengthening this market, says Marcio Fabbris, Vivo B2C Vice President.

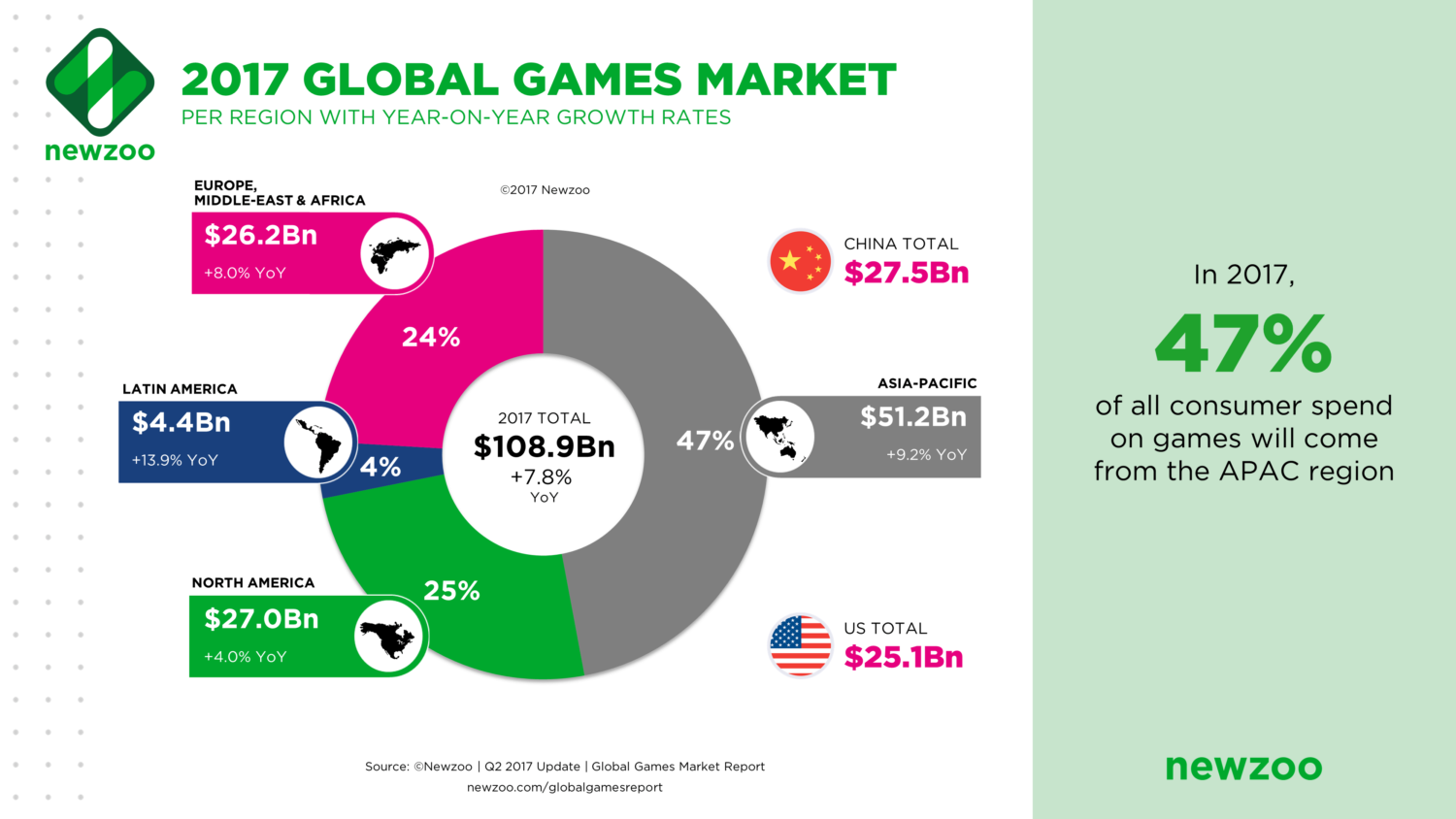

Brazil represents only 1.4% of the “game enthusiasts” population, with 30 million consumers generating US$1.3 billion, according to Newzoo Report. Compared to the global figures these are not impressive numbers at all, but for Marcio Farris it is clear that “each year, the game market consolidates itself as one of the greatest drivers of the digital economy in Brazil,” whose revenue is just behind that of Mexico in Latin America. The region is expected to grow by 13.9% year over year – the highest rate worldwide – to reach US$4.4 billion this year and US$6.3 billion by 2020.

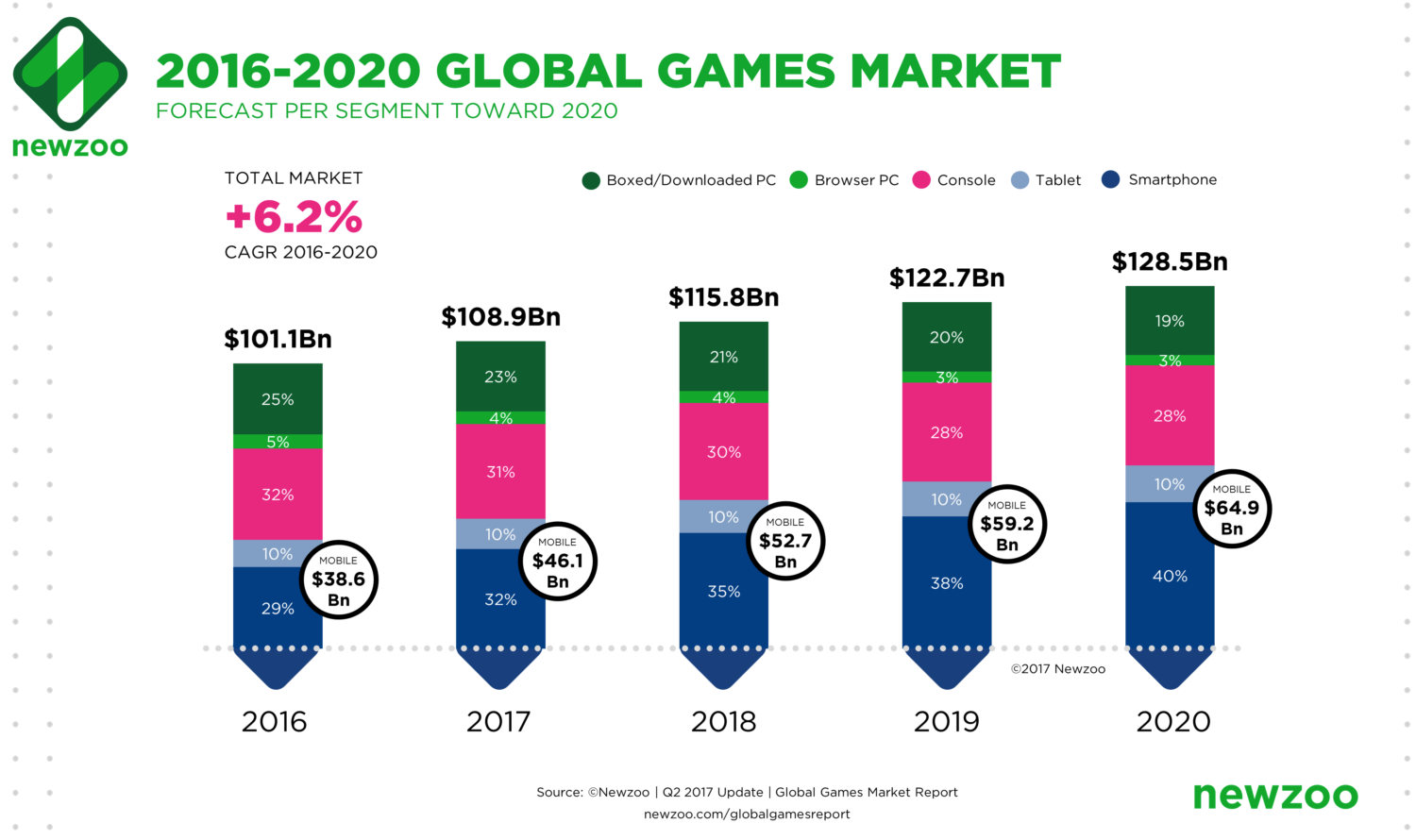

The figures presented in Newzoo’s 2017 Global Games Market Report support Vivo’s strategy, as consumers increase their migration to mobile gaming. Already the largest segment – accounting for 42% of the total global gaming market –, mobile (smartphones and tablets) growth is set to continue, claiming 50% of the market by 2020.

Brazil: Inside the Game

In Brazil, there are some 30 million gamers generating about US$1.3 billion in revenues. These figures are mainly related to clients of the giants of the entertainment industry. But behind the screen, the Brazilian games market is experimenting a very exciting moment, exploring the more independent sector. “The development of indie games in Brazil is booming,” says Eliana Russi, Executive Director of the Brazilian Association of Digital Games Developers (Abragames, in Portuguese). “In 2008, we counted 43 companies, in 2014 we jumped to 130 and today we have 300.”

According to Abragames, 70% of Brazilian developers begin their business as outsourcing companies, but many are growing beyond that role. “We started in 2012 creating games for other companies and nowadays we are focused on producing our own brain puzzle games. This is our niche: games to exercise the brain.” João Vítor de Souza – CEO at Cupcake Entertainment – explains that defining a niche was a key decision to achieving a 45% year over year growth, with 90% of their consumers being women 35+ and most of them from the US.

Having their main consumers out of the country is a common feature of the Brazilian indie games industry, which saw its exporting revenues jump from US $1.5 million in 2013 to US $19 million in 2017. Eliana Russi says that “it is amazing how this industry responds and does not take any opportunity for granted.” Abragames and ApexBrasil – Brazilian Trade and Investment Promotion Agency – support and organize delegations to events abroad and are also behind the 3rd biggest game event in the world, hosted annually in São Paulo City. BIG Festival – Brazilian Indie Games Festival – will be hosting its 6th edition. “Our main goal is to keep growing the international business and get the Brazilian game consumers closer to the Brazilian game developers.”

Another push is coming from the government. Ancine – the Brazilian agency that regulates the audiovisual market – approved tax incentive mechanisms and FINEP – a Research and Innovation public company –is selecting companies in which to invest and help them take the first steps into the market. João Souza says it is very good to see these moves. “For sure it will help the beginners, but for the ones already in the game the main sources are really coming from abroad.”

In Cupcake’s case, 80% of the company’s revenues come from the international market, especially the U.S. In tune with the mobile wave, the company’s 03 brain puzzle games – initially accessible on Facebook – are already available for smartphones. João Souza notes that due to the demand, all new products are already being created for mobile devices. “Our long term goal is to be the world’s number one company in brain puzzle games. Recently we got an investment of US$1 million from Playlab – of Thailand – to help us achieve this audacious goal”, states the Cupcake CEO. As the Executive Director of Abragames says, Brazilian game developers are alert and taking every opportunity to play big in this promising market.

CHECK OUT prior articles of BRAZIL CORNER:

Brazil Corner: How São Paulo Intends to Become a Center of Film Production

BRAZIL Corner:João Daniel Tikhomiroff – On the Intricacies of the Brazilian Audiovisual Market

João Daniel Tikhomiroff – On Branded Entertainment, New Financing Models and More (Part 2)

BRAZIL Corner: Despite Cord-Cutting, Pay TV Gains Ground In Advertising and Audience per Minute