The closing of Canela Media’s US$ 32 million Series A funding round is one of the few relatively sizable investments in digital media companies in the last few years, particularly in Hispanic digital media. Four things you need to know.

1. Digital Media Funding: Size and Investors

The size of Canela Media’s funding is relatively large, particularly in the current environment in which digital media funding is slowing. Investors are no longer willing to shell out hundreds of millions of dollars on new digital media sites as they used to do until 2015 (e.g. BuzzFeed, Vox Media and Vice Media, for the Hispanic and Latin American markets where investors funded Mitu with more than US$ 50 million. )

Canela Media announced the completion of an oversubscribed US $32 million Series A funding round. The investment was co-led by Acrew Capital and Angeles Investors with participation from Link Ventures, TEGNA Ventures and Samsung NEXT. BMO Harris Bank provided an additional US $10 million of capital. In addition, existing investors BBG Ventures, Mighty Capital, Reinventure Capital, Portfolia’s Rising America Fund, Alumni Ventures and Powerhouse Capital continued its participation, bringing Canela Media’s total funding to date to US $35 million.

Canela Media’s funding will be used to help Canela Media accelerate product development, produce new high-quality original programming for its flagship products Canela.TV and Canela Music, and to enable expansion further into Latin America. Later this year, Canela will roll out the Canela Kids app focused on children’s programming. The company will also be adding 95 new positions in various functions, including engineering, operations and programming.

2. Digital Media Funding Drivers: Hispanic Growth

One of the digital media funding investment rationales for Canela is the expanding target market; the Hispanic and Latin American consumer markets. Richard Wolpert, venture partner at Acrew Capital, one of Canela Media’s investors stated, “We continue to see significant business opportunities and growth coming from the U.S. and Latam Hispanic consumer segment, particularly in streaming media where consumers are looking for viewing options tailored to not only their language, but also their content consumption desires. Canela Media’s approach of “For Latinos, by Latinos” has helped them remain authentic and attract brands seeking to truly connect with multicultural audiences.”

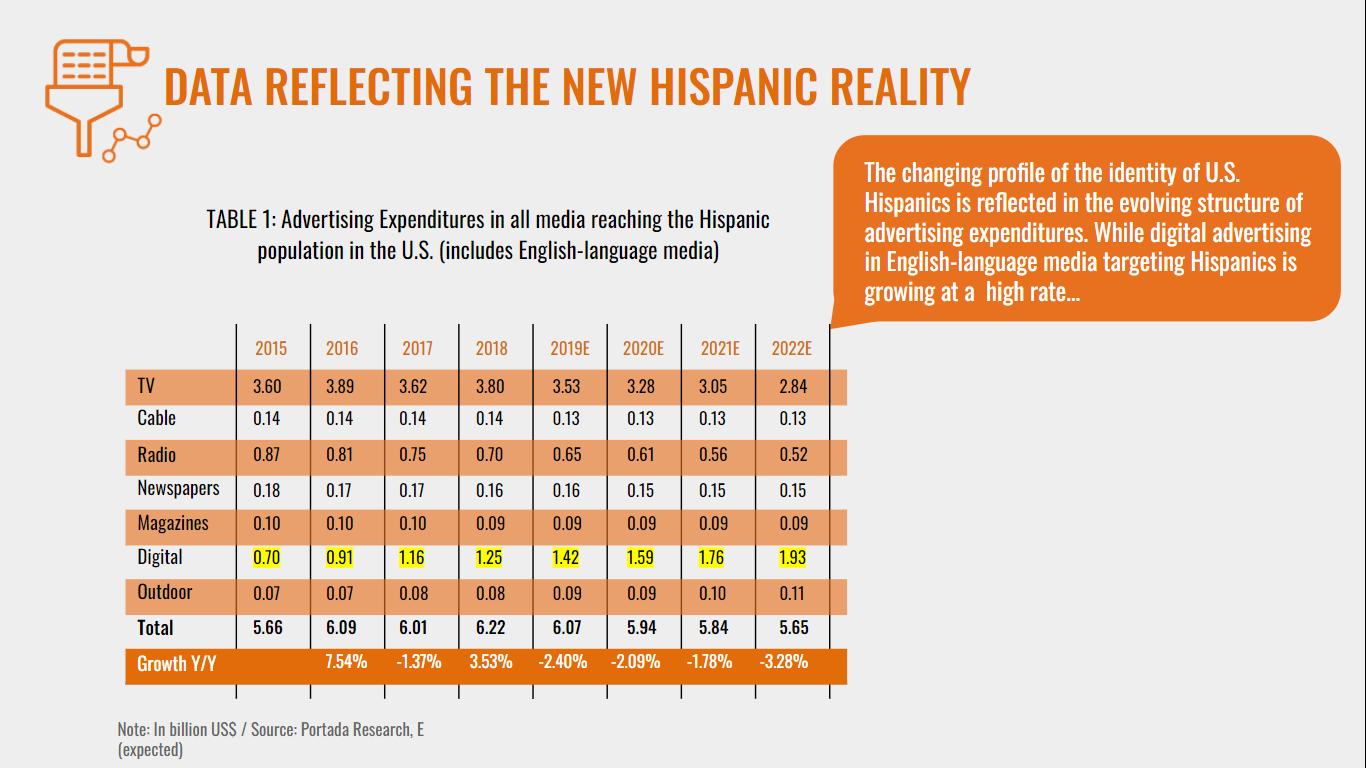

Portada estimates that digital advertising targeting Hispanics will grow to US $ 1.93 billion in 2022. Approximately 80% of that amount is sold by Google, Facebook and other social media properties, leaving approximately US $380 million to other players. The growing Hispanic digital advertising market is a sweet spot Canela Media can reap substantial growth from (see chart below and for more information check out our Insights Report How brands engage U.S. Hispanics: New segmentation approaches). However, Hispanic digital media market growth is particularly driven by advertising to English-language Hispanics. However, Canela Media is mostly targeted to the Spanish-language market in the U.S (Spanish-dominant Hispanics). where demographic trends clearly show a declining audience.

“From inception, we made it our mission to serve the underrepresented U.S. Hispanic consumer, while bridging the gap to multicultural audiences for marketers. We look forward to helping more brands capitalize on our unparalleled and in-depth knowledge and understanding of how to establish meaningful and culturally relevant connections with U.S. Hispanics,” said Isabel Rafferty, Founder and CEO of Canela Media.

3. The CTV-AVOD Expansion

The Connected TV CTV) market grew at a 60% annual rate to an overall U.S volume of US $14.4 billion in 2021. With Hispanic and Latin American audiences being particularly prone to cutting the cord, advertising via OTT and CTV, one of Canela Media’s core offerings, is poised to grow. With OTT and CTV revenues, companies like Canela Media attempt to take digital advertising market share away from players that are traditionally broadcast oriented like Univision and Telemundo. This trend is also driven by AVOD (Advertising Video on Demand) expected increase in 2022 and beyond due to the saturation of the subscription video on demand market (SVOD).

“We believe this team, combined with its truly unique platform and approach, will unlock the full potential of the U.S. consumer market,” said Rodrigo Garcia, advisor at Angeles Investors. “Our firm’s investment philosophy is all about finding the most exciting startups, funding the most disruptive and fastest growing business models and growing the impact of Hispanic and Latino entrepreneurs in the U.S. economy. With Canela Media, we have discovered the perfect match.”

Launched in 2020, Canela.TV, one of the first AVOD streaming services for U.S. Hispanics/Latinos, is now approaching 10 million downloads. Canela.TV also has a wide distribution of FAST channels through partners such as Samsung, XUMO and LG. Canela Music launched in 2021 with a variety of music genres and original content. The company reaches over 50 million users across their OTT products and 180 Spanish content sites.

4. Female and Minority Owned

Another driver for digital media funding in companies with Canela Media’s characteristics is the dearth of minority and women owned companies. Canela Media is both woman and minority owned. In fact the company claims that it is the single largest funded, Latino-owned company. Additionally it has obtained, the 4th largest amount of funding for a female in the media industry.

Latinos create more business ventures per capita than any other U.S. racial or ethnic group, comprising 18% of the population. Yet, they still receive less than 2% of all venture funding, Digital media investors see an opportunity there.