What: Kantar has published the results of a study that aims to understand millennial households in Latin America.

Why it matters: A quarter of the population of Latin America is millennial, and they account for 24% of total FMCG spend – equivalent to US $30 billion dollars.

Millennials are on every marketer’s mind, for one reason or another. In Latin America, they account for 24% of total FMCG spend, equivalent to US $30 billion dollars. Most of them are grown-ups, which means marketers should be thinking of understanding not only how they behave, but also how they fulfill their responsibilities and care for their families.

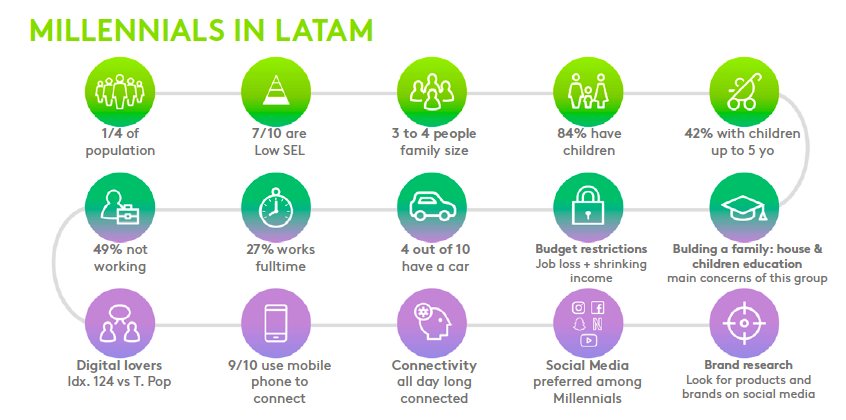

Kantar has released the results of a study titled Demystifying Millennial Families that aims to provide the full picture: what’s on millennials’ minds? What are their households like? What are their priorities? While it’s true that they are digitally connected all day every day, this also means they expect products, services, and experiences to be personalized, so brands need to be able to tailor their message specifically for their target if they wish to make an impact. Below are a few of the study’s main findings.

Kantar has released the results of a study titled Demystifying Millennial Families that aims to provide the full picture: what’s on millennials’ minds? What are their households like? What are their priorities? While it’s true that they are digitally connected all day every day, this also means they expect products, services, and experiences to be personalized, so brands need to be able to tailor their message specifically for their target if they wish to make an impact. Below are a few of the study’s main findings.

Millennial Families: What Makes Them Different

According to Kantar’s report, 8 in every 10 millennial households have young children, defining to a great extent the family’s cares and concerns. Two-thirds (66%) of these households are low-income families, and half are getting by on a single income. Half of millennial housewives in Latin America do not have jobs and the ones who do only work part-time. If we add to that the financial pressures of the country they live in, millennials have it difficult. Because of this reason, they are switching to economy brands and looking for special promotions.

High-income families, on the contrary, represent 34% of the millennial population in Latin America. They tend to have smaller families, of one or two people and are less likely to have kids.

What Do They Buy?

To a great extent, what millennial families buy (and how they buy) depends on their income and whether they have children. The report shows 63% of high-income families own a car, compared to only 22% of low-income families.

Millennials are also spending a big percentage of their budget on groceries, and e-commerce is growing fast in this category. As said in the report, this is set to be an increasingly key channel through which to reach millennials, with value share expected to reach 5% in Argentina and 3% in Brazil and Mexico by 2025.

The products in millennials’ baskets are directly related to their families’ needs. Diapers, powdered milk, snacks, biscuits, and bread are the most-bought products among low-income households, making up 15% of the value share. UHT milk, beer, yogurt, pet food, and cheese are the top categories (14.5% value share) for high-income families. As for their online purchases, personal care products make up almost half of all FMCG products bought online by millennials, twice that of the general population.

As the report concludes, marketers really need to be aware that the millennial generation has grown, and so have their hopes and responsibilities: “It’s time to revisit millennial shoppers and adjust our view of who they are – recognizing the line that exists between high-income and low-income households. Only then can we successfully reach, target and engage this vitally important group.”

[ctalatamb]