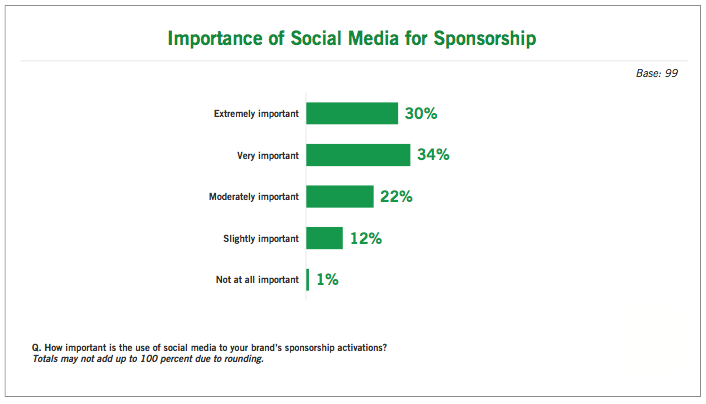

What: Social media — particularly Facebook, Twitter, and Instagram — has emerged as a key component in supporting sponsorship activations among a great majority of marketers, according to a new study by the ANA (Association of National Advertisers).

Why it matters: The study revealed that 85 percent of the marketers surveyed use social media to support sponsorships before, during, and after the sponsorship.Additionally, almost half (44 percent) employ a range of “advanced technologies” such as 360-degree photography, beacons, virtual reality, and RFID (radio-frequency identification) as support for their sponsorship activations.

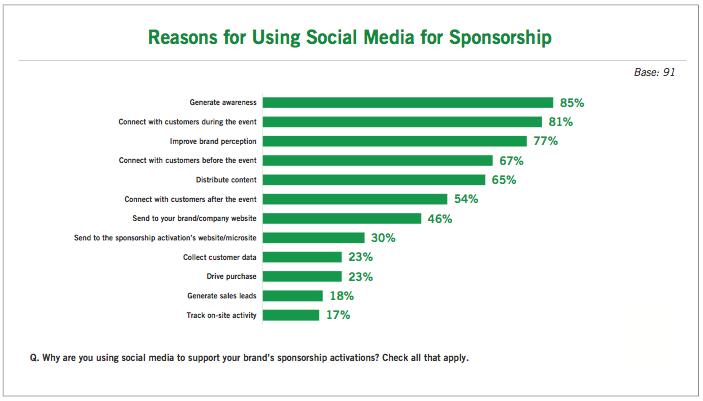

The study, “Use of Social Media and Advanced Technologies for Sponsorship,” indicated that the primary reasons marketers use either social media or advanced technologies to support a brand’s sponsorship activations were the same:

- Generate awareness

- Connect with customers during the event

- Improve brand perception

“Sponsorships are becoming an increasingly important part of the marketing mix, and with good reason,” said ANA CEO Bob Liodice. “Giving those activities a boost via the aggressive use of social media and other new technologies makes sense because of the ROI it provides.”

Sponsorship spending in North America is projected to be $23 billion in 2017, according to ESP/IEG, a consultancy that tracks sponsorship spending and trends. Sports events dominate the list of all sponsorship spending, accounting for about 70 percent, followed by entertainment at 10 percent.

Preferred social media platforms used to activate sponsorship included:

- Facebook (92 percent)

- Twitter (87 percent)

- Instagram (70 percent)

- YouTube (47 percent)

- LinkedIn (41 percent)

- Facebook Live (27 percent)

- Snapchat (27 percent)

- Pinterest (13 percent)

The study noted that internal resources are most often used for the management of social media and/or advanced technologies to support a brand’s sponsorship activations; external agency resources are also used (e.g., digital/social agency and sponsorship agency), but to a lesser extent.

In addition, the amount of social media exposure generated was the top choice, by a wide margin, for measuring the effectiveness of a brand’s social media sponsorship activity. For advanced technologies, on-site activity tracked at the sponsorship event and the amount of social media exposure generated were the two top choices for measuring effectiveness.

METHODOLOGY

The survey was conducted in June 2017. In total, 119 ANA corporate members participated. Of those, 55 percent were characterized as “senior marketers” (director level and above) while 45 percent were “junior marketers” (manager level and below). Forty-nine percent of respondents had 15 years or more experience in marketing/advertising. Seventy-seven percent work at organizations with an annual U.S. media budget of less than $100 million; the other 23 percent work at organizations with an annual U.S. media budget of $100 million or more. Those organizations are primarily B-to-C (38 percent) with some B-to-B (20 percent), and B-to-C/B-to-B for the remainder.

For purposes of the survey, the term sponsorship was defined as “a cash and/or in-kind fee paid to a property (typically sports, entertainment, non-profit event, or organization) in return for access to the exploitable commercial potential associated with that property.” A property was defined as “a unique, commercially exploitable entity, typically in sports, arts, events, entertainment, or causes.”